The Spending Illusion: Why It Feels Like Everyone’s Buying—Even When They’re Not

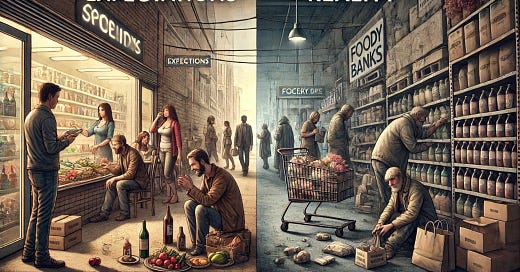

If consumers are supposedly cutting back, why does it still feel like the world is on a spending spree? Malls are full, influencer hauls haven’t slowed down, and every new product drop still manages to sell out. Are we in a paradox where people are both tightening their wallets and spending like there’s no tomorrow?

Actually, yes.

The most recent VML ‘Future 100’ report captures this contradiction perfectly: consumers are cost-cutting in some areas while splurging in others. It’s the new economic reality—people are making trade-offs, prioritizing wellness, self-discovery, and experiences over mindless consumption. And yet, thanks to the combined forces of social media, financial illusions, and media narratives, it still looks like spending is at an all-time high.

For marketers, this raises a crucial question: Are we selling to reality, or just playing into the illusion?

1. The Social Media Mirage: We See the Spending, Not the Sacrifices

The VML report notes that today’s consumers are actively shaping their own realities—sometimes with optimism, sometimes as a means of escape. 67% of Gen Z like the idea of using technology to escape to a different reality, and in many ways, social media is that alternate world.

And what does this world look like? Endless travel, constant shopping, and luxury as the default lifestyle. But here’s what’s not visible:

The purchases that don’t happen.

The credit card debt behind the shopping spree.

The quiet financial anxiety hidden behind picture-perfect content.

VML’s research points to a major shift in consumer behavior: people are intentionally buying less stuff (nearly 70% say they are actively trying to own less). Yet, thanks to the selective nature of social sharing, what’s visible is not what’s real.

For brands, the key takeaway is simple: don’t mistake the highlight reel for mass behavior.

2. Financial Sleight of Hand: Why Spending Looks Bigger Than It Is

Yes, consumers are still buying—but how they’re buying has changed. The rise of Buy Now, Pay Later (BNPL) services, credit cards, and subscription models makes spending seem effortless, even when budgets are tight.

People aren’t necessarily spending more—they’re just spreading it out.

“Small, manageable payments” trick the brain into thinking purchases are affordable.

The Curator Economy (highlighted in Future 100) encourages micro-spending—think digital collectibles, limited drops, and one-click impulse buys.

For marketers, this is where accountability matters. Are we helping consumers make informed financial choices, or are we luring them into purchases that feel risk-free but add up over time? The brands that prioritize transparency will win trust in the long run.

3. Selective Spending: The Age of Trade-Offs

The VML report clarifies one thing: People aren’t just spending less—they’re spending differently.

Experiences over objects: Solo travel (Destination Solitude, 22) and wellness retreats (Blue Zone Retreats, 23) are booming because they offer emotional fulfillment.

Health is non-negotiable: Whether it’s functional foods (Circadian Snacking, 45) or home healthcare tech (Home Clinic Hubs, 85), well-being is a top priority.

Luxury is justified, not impulsive: The rise of “smart indulgence” means people will splurge—if they can rationalize it.

For brands, this means selling the “why,” not just the “what.” Consumers don’t want to be guilted into spending; they want to feel like their purchases align with their values. The days of mindless consumption are over—welcome to the era of intentional spending.

4. Media Loves a Contradiction

Finally, let’s talk about the elephant in the room: the media thrives on economic contradictions.

One headline screams, “Consumers Are Cutting Back!”

The next report, “Holiday Spending Hits Record Highs!”

Meanwhile, social feeds are flooded with brand collabs, influencer hauls, and travel vlogs.

Why the mixed signals? Because both narratives sell. The reality is nuanced. As the Future 100 report highlights, consumers are navigating a world where optimism and fear, cutting back and splurging, and digital and analog pursuits coexist.

For marketers, the lesson is clear: don’t chase headlines—chase consumer realities. Instead of reacting to every economic news cycle, focus on long-term behavioral shifts.

The Ethical Marketing Imperative

So, what does this mean for brands that care about marketing accountability? It means recognizing that:

✅ Consumers are under financial pressure—even if it doesn’t always look like it.

✅ They’re making trade-offs, not going on spending sprees.

✅ They want value and purpose, not just another product.

What Marketers Need to Do:

✔ Acknowledge the economic climate—without resorting to fear-mongering or manipulation.

✔ Prioritize transparency—in pricing, payment plans, and financial commitments.

✔ Sell meaning, not excess—because consumers aren’t looking for more stuff, they’re looking for value.

At the Marketing Accountability Council (MAC), we believe that the brands that embrace reality over illusion will be the ones that win consumer trust—and long-term success.

The question isn’t whether people are spending. It’s whether we, as marketers, are being honest about it.